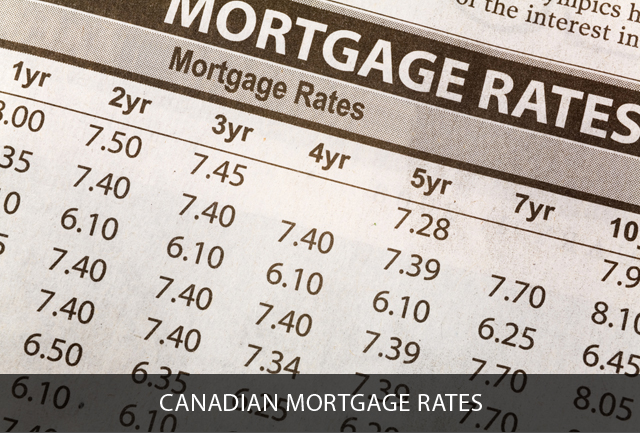

Many prospective homeowners focus mostly on the prices while they search for a new house. It makes sense, considering you’ve probably been pre-approved for a certain amount. However, the mortgage rate is also a critical element and plays a huge role in determining how much you will pay in the long run.

Mortgage rates are determined by many different factors, one of which is employment data.

Why It Matters

The employment rates matter when speaking about mortgage rates because they have an effect on the overall cost of labor. And the overall cost of labor helps determine the rate of inflation, which is an important factor in determining mortgage rates.

When mortgage rates rise and you aren’t sure why it happened, a small supply of unused labor may be the reason. A small supply of workers means wages rise and that’s when the rates will follow.

With a Grain of Salt

It’s still important to take any short-term numbers with a grain of salt. One report won’t necessarily predict the trends with a high degree of accuracy. Employment numbers are prone to fluctuation, so it may be better to focus on long term trends for the most reliable predictor of mortgage rates.

Details of the Report

The latest Canadian employment report says that 7,000 jobs were shed in February, while 15,000 new jobs were expected. In the most recent six months, the average is 3,400 new jobs each month and in the most recent twelve months, the average is 7,900 new jobs per month.

These numbers seem positive, but it’s estimated that 20,000 new jobs are needed each month to keep pace with the size of the Canadian labor force. However, all of the job losses were in the private sector and in part-time positions, so that is a bit of a positive.

Will It Have an Effect?

The job creation in Canada is not impressive, but the Bank of Canada isn’t likely to raise rates anytime soon, because all the extra workers available will help keep inflation down for the time being.

This means that if you are in a position to apply for a mortgage, or will be in the near future, you should be safe as far as mortgage rates are concerned. Of course, numbers move around and are never set in stone, so if you’re ready and the rates are low, don’t wait around too long.